Some 41% of sheep producers in Australia plan to reduce breeding ewe numbers.

The stark prediction stems from the Meat and Livestock Australia (MLA) and Australian Wool Innovation (AWI) May 2025 sheep producers' intentions survey (SPIS).

Within this grouping, 20% of producers recorded that they intend to reduce numbers by 25%.

MLA reports that forecasts for flocks lowering sheep numbers are “due to pressures brought by persistent drought conditions in South Australia, Victoria and southern New South Wales.

"Reduced pasture availability and higher feed costs make it increasingly difficult for producers to maintain larger flocks.”

The root cause of plans to reduce numbers in Western Australia is said to be driven by uncertainty around future market access amid a looming live sheep export ban (1 May 2028).

This, MLA says, has led to 58% of producers in this region indicating breeding ewe flock reductions. It says: “This regional concern underscores the broader need for adaptability and strategic planning across the sector.”

Producer sentiment

While forecasts for reduced ewe numbers are stark, the survey recorded positive producer sentiment.

The measure used is a net sentiment score which was recorded at +52. MLA reports that this is the first time since October 2022 where all states have reported non-negative sentiment.

It appears that sheep producers are relatively positive about the sector, but with reduced numbers. This is likely helped by the recent sharp increase in farmgate prices.

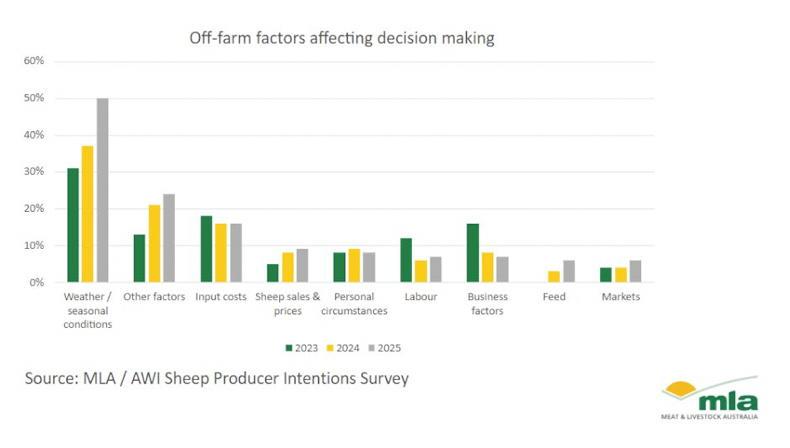

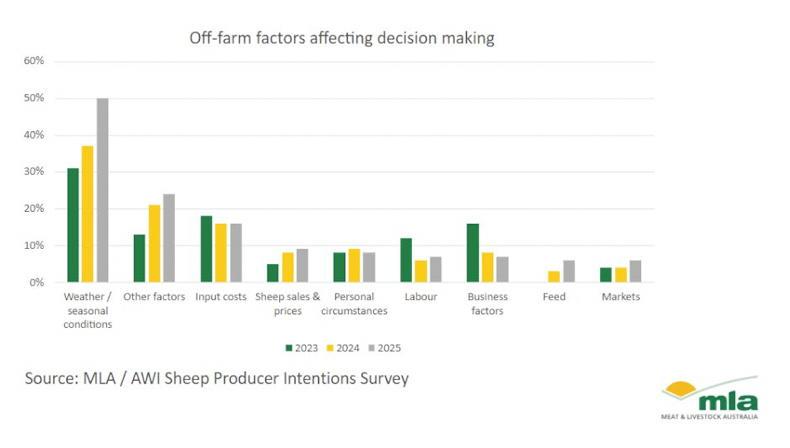

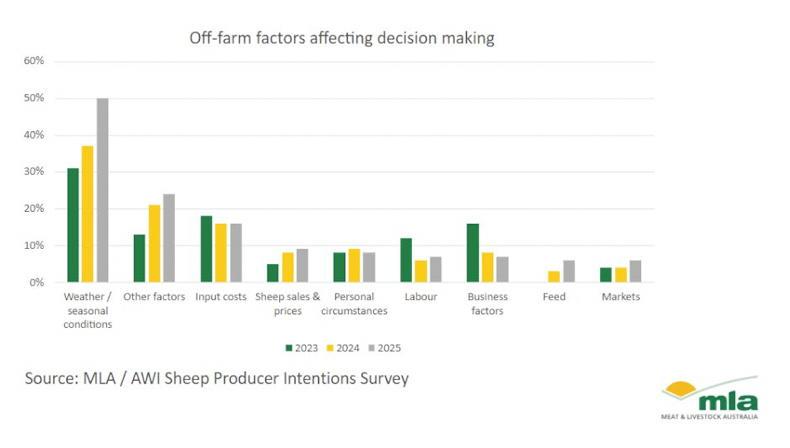

Farctors affecting on- and off-farm decisions on Australian sheep farms.

The Bord Bia sheep price dashboard shows the average Australian lamb price at €5.91/kg in the week of 14 June, some €1.50/kg higher than the corresponding week in 2024.

Key decision drivers

The SPIS collates information about the drivers of producers' on- and off-farm production decisions. “It revealed, again, weather and seasonal conditions remain the most significant off-farm concern[s].

"Additionally, the percentage of producers highlighting them has dramatically increased from 31% in 2023, to 50% in 2025."

Other increasing producer concerns included government policy, regulations, taxes, levies, elections, live export trade, ban and abattoir or processor issues.

“These increased from 13% in 2023 to 24% in 2025. This shift in concerns has reduced the decision-making drivers related to labour issues and business factors.”

Global significance

The survey is significant given the increasing dominance and growth Australia has recorded in sheepmeat exports in recent years.

The country recorded its largest ever exports of sheepmeat in 2024 with lamb or hogget volumes reaching almost 360,000t and mutton exports exceeding 255,000t.

Its free trade agreement with the UK has witnessed export volumes grow and there are concerns about the impact of this on market dynamics.

Read more

2024 was largest year on record for Australian red meat exports

Some 41% of sheep producers in Australia plan to reduce breeding ewe numbers.

The stark prediction stems from the Meat and Livestock Australia (MLA) and Australian Wool Innovation (AWI) May 2025 sheep producers' intentions survey (SPIS).

Within this grouping, 20% of producers recorded that they intend to reduce numbers by 25%.

MLA reports that forecasts for flocks lowering sheep numbers are “due to pressures brought by persistent drought conditions in South Australia, Victoria and southern New South Wales.

"Reduced pasture availability and higher feed costs make it increasingly difficult for producers to maintain larger flocks.”

The root cause of plans to reduce numbers in Western Australia is said to be driven by uncertainty around future market access amid a looming live sheep export ban (1 May 2028).

This, MLA says, has led to 58% of producers in this region indicating breeding ewe flock reductions. It says: “This regional concern underscores the broader need for adaptability and strategic planning across the sector.”

Producer sentiment

While forecasts for reduced ewe numbers are stark, the survey recorded positive producer sentiment.

The measure used is a net sentiment score which was recorded at +52. MLA reports that this is the first time since October 2022 where all states have reported non-negative sentiment.

It appears that sheep producers are relatively positive about the sector, but with reduced numbers. This is likely helped by the recent sharp increase in farmgate prices.

Farctors affecting on- and off-farm decisions on Australian sheep farms.

The Bord Bia sheep price dashboard shows the average Australian lamb price at €5.91/kg in the week of 14 June, some €1.50/kg higher than the corresponding week in 2024.

Key decision drivers

The SPIS collates information about the drivers of producers' on- and off-farm production decisions. “It revealed, again, weather and seasonal conditions remain the most significant off-farm concern[s].

"Additionally, the percentage of producers highlighting them has dramatically increased from 31% in 2023, to 50% in 2025."

Other increasing producer concerns included government policy, regulations, taxes, levies, elections, live export trade, ban and abattoir or processor issues.

“These increased from 13% in 2023 to 24% in 2025. This shift in concerns has reduced the decision-making drivers related to labour issues and business factors.”

Global significance

The survey is significant given the increasing dominance and growth Australia has recorded in sheepmeat exports in recent years.

The country recorded its largest ever exports of sheepmeat in 2024 with lamb or hogget volumes reaching almost 360,000t and mutton exports exceeding 255,000t.

Its free trade agreement with the UK has witnessed export volumes grow and there are concerns about the impact of this on market dynamics.

Read more

2024 was largest year on record for Australian red meat exports

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: