The first half of 2024 has brought mixed fortune for the global dairy industry. Sporadic market activity has again proved challenging.

More tangible positives are some welcome increases in the milk cheque, despite demand being more muted than was hoped.

The prevalent headwind for Irish dairy farmers has been the unfavourable weather conditions and its many knock-on effects.

As a result, Irish milk supply is back close to 6% (or 211 million litres) for the first five months of the year versus the same period last year.

Milk-producing nations across Europe have experienced a similar trend, albeit to varying degrees.

As we pass the mid-point of July, peak season is well behind us and with weather conditions less than ideal for grass growth, come the end of the calendar year, annual milk output will be back.

Dairy exports in 2024

The value of direct Irish dairy exports for the period January to April of this year is estimated at €1.64bn, representing a decrease of €241.7m or 12.8% year on year.

In volume, for the same period, 408.7 million tonnes was exported, a 4.5% fall year on year.

As with all commodity statistics, contextualisation is needed here. While these figures may look stark to some, markets have rallied somewhat, albeit slower and steadier than was hoped.

The lead-lag effect is evident here, with lower 2023 prices crystalising in contracts called off or exported in 2024.

While our exports are back versus last year, owing in part to a decrease in milk production, a facet of less milk availability but debatable is that pent-up demand in late quarter four last year resulted in less unsold inventory, meaning leaner carry-forward stock.

Macro-environmental factors

Similarly, year-on-year milk flow comparisons can make for eye-catching headlines, but again context is required here. In the past decade, the macro environment has had an indelible direct and indirect effect on dairy.

Post-European Union quota abolition (2015), milk volumes increased and, since then, we’ve seen Brexit, European Union internal measures (Private Storage Aid/PSA and intervention), the US tariffs on certain EU goods including butter, the COVID-19 pandemic, war in Ukraine, inflation, war in the Middle East and climate action measures.

These monumental macro factors have played a significant part in the world of most commodities and dairy is not precluded.

To take one relatively recent example, during the COVID years of 2020 and 2021 and owing to unprecedented uncertainty and enforced habitual lifestyle changes, a surge in demand for dairy ensued, which has left an indelible ‘inflated’ statistical nuance which needs calling out in the crude analysis that is year on year.

With much discourse and reference to 2024 being the ‘year of elections’, the macro environment will be keenly watched by all commodity businesses, dairy included.

Promoting Irish dairy

Bord Bia will continue to rigorously promote Irish dairy. A busy schedule of buyer and media visits is currently under way, with 14 buyers recently concluding a five-day visit to Ireland.

The buyer visit is part of a €3.2m Bord Bia campaign, co-funded by the EU, to promote Irish and European dairy across the Philippines, Malaysia, Japan, Thailand and Vietnam.

The campaign, which is 80% funded by the EU, concludes this year after three years.

During the campaign, Bord Bia hosted 50 international dairy buyers on tours around Ireland visiting quality assured dairy farms and Origin Green-verified dairy processors.

To showcase Irish dairy, Bord Bia is also hosting journalists from the US and the UAE this week, while journalists from China and the UK will visit in September.

In autumn, Bord Bia will host trade missions to China, Korea, Thailand and Vietnam, with the Minister for Agriculture set to lead.

Bord Bia is currently recruiting buyers to attend dairy trade seminars hosted during the trade mission.

Bord Bia and the Irish dairy industry will be in attendance at key trade shows such as SIAL, Paris, in October and Food Ingredients Europe, taking place in Frankfurt, this November.

Through these events, the objective is to raise awareness of Ireland’s capability as a dairy supplier, focusing on the widespread farmer participation in the Sustainable Dairy Assurance Scheme and the technical capability of Irish dairy processors.

Spotlight on retailer labels

Haltungsform is an on-pack labelling system that gives transparency to consumers about animal welfare practices on farms.

Animal welfare holds special importance to consumers in some of our main European markets, particularly in Germany, the Netherlands and France.

In response, retailers are eager to provide transparency to consumers with regards animal welfare standards on cattle, sheep, pig and poultry farms.

The Animal Welfare Initiative (Initiative Tierwohl) is an alliance of German food retailers, together with representatives from the farming and meat sectors.

Founded in 2015, all major continental retailers are members of the initiative.

As part of the alliance, retailers agreed to source meat and dairy from animals raised above the legal minimum standard for animal welfare.

The initiative introduced the Haltungsform (husbandry system) label on packs of fresh meat in 2019 and on dairy products in 2022.

Haltungsform is an on-pack labelling system for meat and dairy products, designed to provide transparency to consumers with regards animal welfare practices on farms.

It has been adopted by all the German retailers.

Haltungsform is characterised by four levels in which each level increases the suggested quality of life for farmed animals ie level one satisfies basic requirements, level four satisfies the highest standards.

In this context, Bord Bia will continue to highlight the positive differentiators of our farming systems in these markets.

Nearly 16,000 dairy farmers are members of Origin Green through the Sustainable Dairy Assurance Scheme (SDAS).

Bord Bia gathers a range of farm metrics through the audit process. Farmers provide this information through the sustainability survey, completed as part of the audit.

The information reported is reliant on the accuracy of the data provided. Using this data, Bord Bia can track improvements in farm management practices.

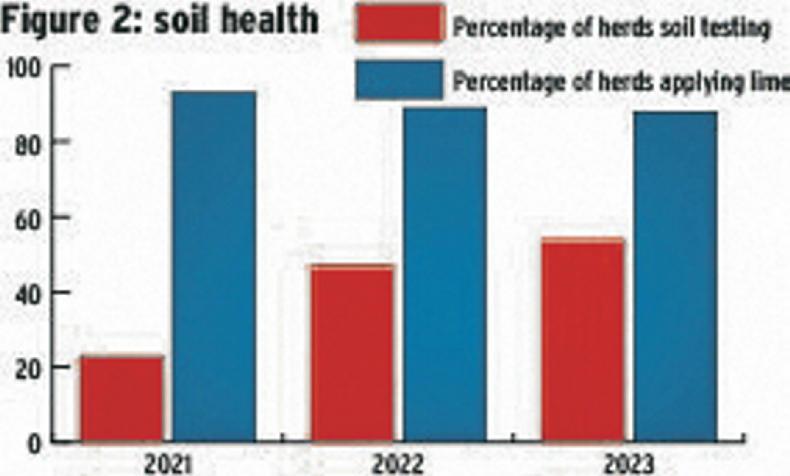

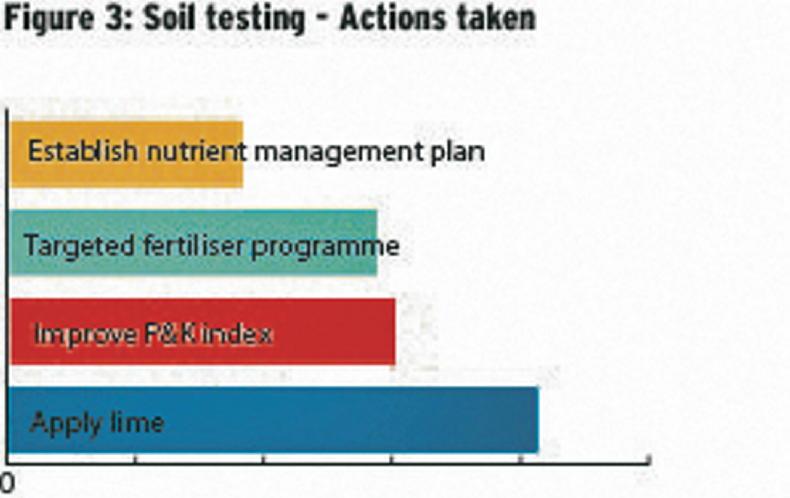

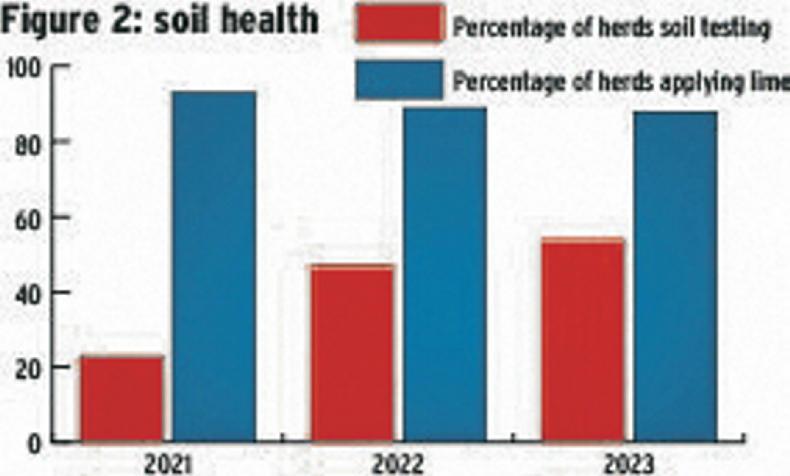

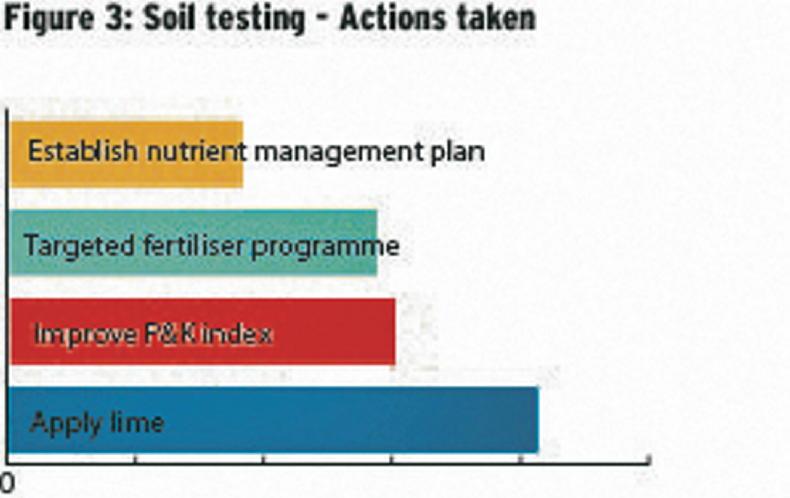

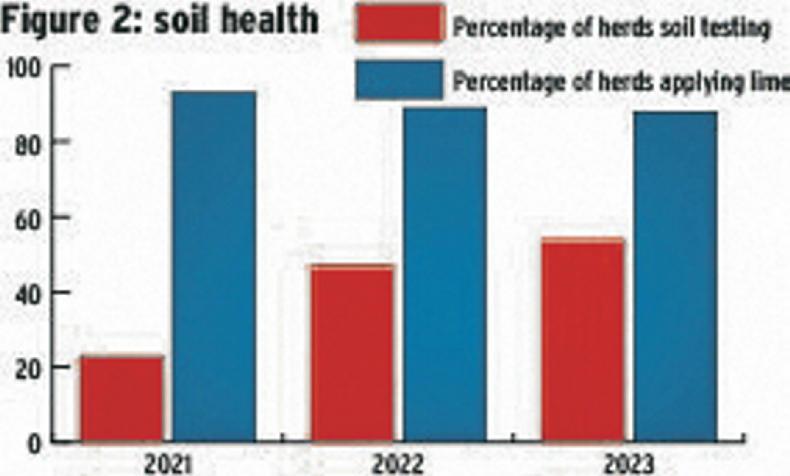

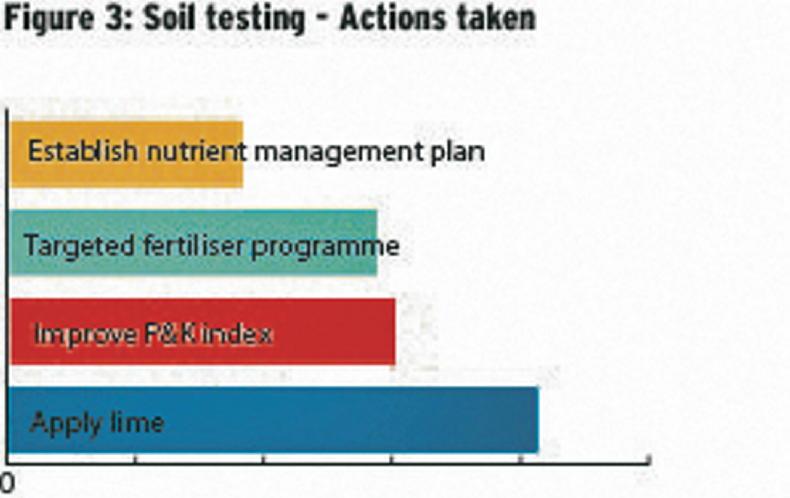

Bord Bia began tracking rates of soil testing and milk recording in 2022. Both actions are useful to assist with decision making on farms to help improve overly efficiency and thus carbon efficiency.

Audit metrics:

Milk recording – frequency (QA dairy)

Figure 2

Soil health (QA dairy)

Figure 3

Soil testing – actions taken (QA dairy)

The first half of 2024 has brought mixed fortune for the global dairy industry. Sporadic market activity has again proved challenging.

More tangible positives are some welcome increases in the milk cheque, despite demand being more muted than was hoped.

The prevalent headwind for Irish dairy farmers has been the unfavourable weather conditions and its many knock-on effects.

As a result, Irish milk supply is back close to 6% (or 211 million litres) for the first five months of the year versus the same period last year.

Milk-producing nations across Europe have experienced a similar trend, albeit to varying degrees.

As we pass the mid-point of July, peak season is well behind us and with weather conditions less than ideal for grass growth, come the end of the calendar year, annual milk output will be back.

Dairy exports in 2024

The value of direct Irish dairy exports for the period January to April of this year is estimated at €1.64bn, representing a decrease of €241.7m or 12.8% year on year.

In volume, for the same period, 408.7 million tonnes was exported, a 4.5% fall year on year.

As with all commodity statistics, contextualisation is needed here. While these figures may look stark to some, markets have rallied somewhat, albeit slower and steadier than was hoped.

The lead-lag effect is evident here, with lower 2023 prices crystalising in contracts called off or exported in 2024.

While our exports are back versus last year, owing in part to a decrease in milk production, a facet of less milk availability but debatable is that pent-up demand in late quarter four last year resulted in less unsold inventory, meaning leaner carry-forward stock.

Macro-environmental factors

Similarly, year-on-year milk flow comparisons can make for eye-catching headlines, but again context is required here. In the past decade, the macro environment has had an indelible direct and indirect effect on dairy.

Post-European Union quota abolition (2015), milk volumes increased and, since then, we’ve seen Brexit, European Union internal measures (Private Storage Aid/PSA and intervention), the US tariffs on certain EU goods including butter, the COVID-19 pandemic, war in Ukraine, inflation, war in the Middle East and climate action measures.

These monumental macro factors have played a significant part in the world of most commodities and dairy is not precluded.

To take one relatively recent example, during the COVID years of 2020 and 2021 and owing to unprecedented uncertainty and enforced habitual lifestyle changes, a surge in demand for dairy ensued, which has left an indelible ‘inflated’ statistical nuance which needs calling out in the crude analysis that is year on year.

With much discourse and reference to 2024 being the ‘year of elections’, the macro environment will be keenly watched by all commodity businesses, dairy included.

Promoting Irish dairy

Bord Bia will continue to rigorously promote Irish dairy. A busy schedule of buyer and media visits is currently under way, with 14 buyers recently concluding a five-day visit to Ireland.

The buyer visit is part of a €3.2m Bord Bia campaign, co-funded by the EU, to promote Irish and European dairy across the Philippines, Malaysia, Japan, Thailand and Vietnam.

The campaign, which is 80% funded by the EU, concludes this year after three years.

During the campaign, Bord Bia hosted 50 international dairy buyers on tours around Ireland visiting quality assured dairy farms and Origin Green-verified dairy processors.

To showcase Irish dairy, Bord Bia is also hosting journalists from the US and the UAE this week, while journalists from China and the UK will visit in September.

In autumn, Bord Bia will host trade missions to China, Korea, Thailand and Vietnam, with the Minister for Agriculture set to lead.

Bord Bia is currently recruiting buyers to attend dairy trade seminars hosted during the trade mission.

Bord Bia and the Irish dairy industry will be in attendance at key trade shows such as SIAL, Paris, in October and Food Ingredients Europe, taking place in Frankfurt, this November.

Through these events, the objective is to raise awareness of Ireland’s capability as a dairy supplier, focusing on the widespread farmer participation in the Sustainable Dairy Assurance Scheme and the technical capability of Irish dairy processors.

Spotlight on retailer labels

Haltungsform is an on-pack labelling system that gives transparency to consumers about animal welfare practices on farms.

Animal welfare holds special importance to consumers in some of our main European markets, particularly in Germany, the Netherlands and France.

In response, retailers are eager to provide transparency to consumers with regards animal welfare standards on cattle, sheep, pig and poultry farms.

The Animal Welfare Initiative (Initiative Tierwohl) is an alliance of German food retailers, together with representatives from the farming and meat sectors.

Founded in 2015, all major continental retailers are members of the initiative.

As part of the alliance, retailers agreed to source meat and dairy from animals raised above the legal minimum standard for animal welfare.

The initiative introduced the Haltungsform (husbandry system) label on packs of fresh meat in 2019 and on dairy products in 2022.

Haltungsform is an on-pack labelling system for meat and dairy products, designed to provide transparency to consumers with regards animal welfare practices on farms.

It has been adopted by all the German retailers.

Haltungsform is characterised by four levels in which each level increases the suggested quality of life for farmed animals ie level one satisfies basic requirements, level four satisfies the highest standards.

In this context, Bord Bia will continue to highlight the positive differentiators of our farming systems in these markets.

Nearly 16,000 dairy farmers are members of Origin Green through the Sustainable Dairy Assurance Scheme (SDAS).

Bord Bia gathers a range of farm metrics through the audit process. Farmers provide this information through the sustainability survey, completed as part of the audit.

The information reported is reliant on the accuracy of the data provided. Using this data, Bord Bia can track improvements in farm management practices.

Bord Bia began tracking rates of soil testing and milk recording in 2022. Both actions are useful to assist with decision making on farms to help improve overly efficiency and thus carbon efficiency.

Audit metrics:

Milk recording – frequency (QA dairy)

Figure 2

Soil health (QA dairy)

Figure 3

Soil testing – actions taken (QA dairy)

This is a subscriber-only article

This is a subscriber-only article