When trying to decide how to care for a sick or elderly relative, it is essential to know your rights around carer’s leave, in case you decide to leave work and care for them at home.

Carer’s leave allows employees to leave work temporarily to provide full-time care and attention to someone who needs it.

To qualify for carer’s leave you must have worked for your current employer for 12 months without a break in employment. Also, the person you are caring for must need full-time care and attention, which is decided by an officer of the DSP after checking with their GP.

How long is carer’s leave?

The length of time you can take is a minimum of 13 weeks and up to a maximum of 104 weeks.

In the application, you can decide to take carer’s leave in one continuous period for the 104 weeks or for several shorter periods that add up to 104 weeks.

If you decide not to take it in one continuous period, there must be a gap of at least six weeks between each period of carer’s leave. If you ask to take less than 13 weeks of carer’s leave, your employer can refuse your request, but they must have a good reason and explain so in writing.

If two people live together and both need full-time care and attention, you can get carer’s leave for each of them.

How do you get paid?

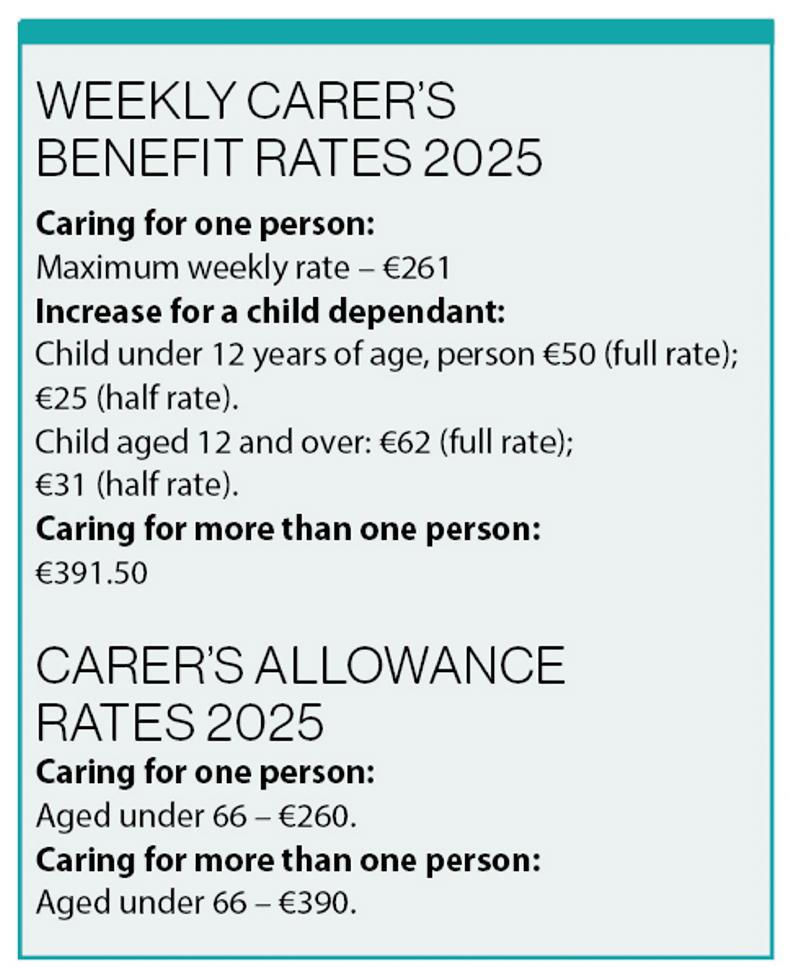

During this period you will not be paid by your employer as the leave is unpaid, but if you have enough PRSI contributions, you can apply for Carer’s Benefit.

Carer’s Benefit is paid to people who have to leave work or reduce their hours to care for a person in need of full-time care.

If you don’t have enough PRSI contributions or you don’t qualify for Carer’s Benefit, you can apply for a means-tested Carer’s Allowance.

This is a weekly social welfare payment for people who care for someone because of their age, disability or illness (including mental illness).

To qualify for Carer’s Allowance, your income must be below a certain threshold. In the means test, the Department of Social Protection (DSP) looks at all your sources of income. They also take into consideration your spouse, civil partner, or cohabitant’s income.

When on carer’s leave, you can still work to supplement your income (but not with your employer). This is a maximum of 18.5 hours a week in employment or self-employment, and you must earn less than €450 a week. This amount will increase to €625 in July of this year.

How to apply for carer’s leave

1. Apply to the Department of Social Protection (DSP)

First things first – you’ll need to apply to the DSP to get carer’s leave. They have to confirm that the person you’ll be looking after needs full-time care, as confirmed by a GP. Your employer also has a section to complete on the form, to confirm that you’re currently working with them.

The DSP will review your case. If your application is accepted and you think you’re eligible, you’ll also need to fill out the Carer’s Benefit application form.

If you application is not accepted, you can appeal the decision.

2. Apply to your employer

If you are approved for carer’s leave, you then need to inform your employer. Ideally, you should give them at least six weeks’ notice. If there’s an emergency, it is important to inform them as soon as you can.

When you write to your employer, make sure your letter states that you’re requesting carer’s leave under the Carer’s Leave Act 2001 and that you have been approved by the DSP. You should also include the date you want the leave to start, and how you plan to take it – whether that is in one block or multiple blocks.

When you want to return to work, you must give at least four weeks’ notice in writing. Your employer needs to write to the DSP to tell them the date you will be returning.

Is Carer’s Allowance different?

Carer’s Allowance is a payment available to people on low incomes to help them with their caring duties. It is not the same as Carer’s Benefit, which is a payment for people who leave insured jobs and become carers. You pay tax on Carer’s Allowance payments as a normal part of your income.

There are several different rates of payment for people receiving Carer’s Allowance. The amount you get will depend on whether you’re over or under 66, how many people you’re caring for and whether you have any child dependents.

See services.mywelfare.ie; gov.ie/carersallowance and workplacerelations.ie.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: