The week the Irish Farmers Journal has introduced a graph that shows an aggregated selling price received by factories for sales of 500g packs of 5% fat mince, a composite hindquarter and a composite forequarter price.

While most people will quickly relate to what a 500g pack of mince looks like, a composite hindquarter and forequarter price will only make sense to people with some knowledge of the beef trade.

Basically the composite value for the hindquarter and forequarter is calculated by taking the value of each cut of beef plus the fat, gristle and bone and applying their percentage share of the carcase to work out its contribution to the overall value. Working the value of beef sales back to a hindquarter and forequarter value is done by applying this to every single item that is sold from the carcase. It can be compared with building a jigsaw where the individual cuts of beef, fat, bones and gristles are the jigsaw pieces and the beef carcase is the completed picture.

Where the value lies

Figure 1.

Figure 1 shows the different types of beef cut that are taken from a carcase. It shows the individual weight of each cut and what percentage it is of the overall carcase. Some of these such as the striploin, fillet, and silverside will be familiar to beef shoppers while many of the others will be recognised only by people with a more detailed knowledge of the beef trade. It should also be noted that different customers have different specifications and this will effect the weight and yield of specific cuts.

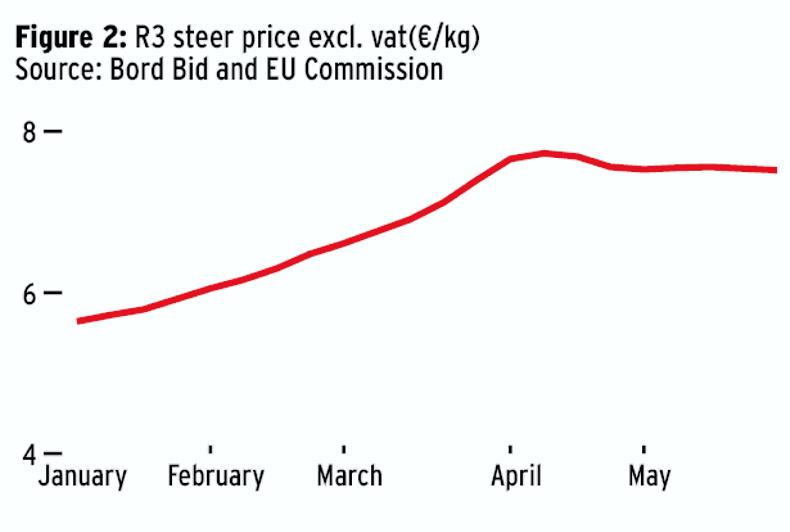

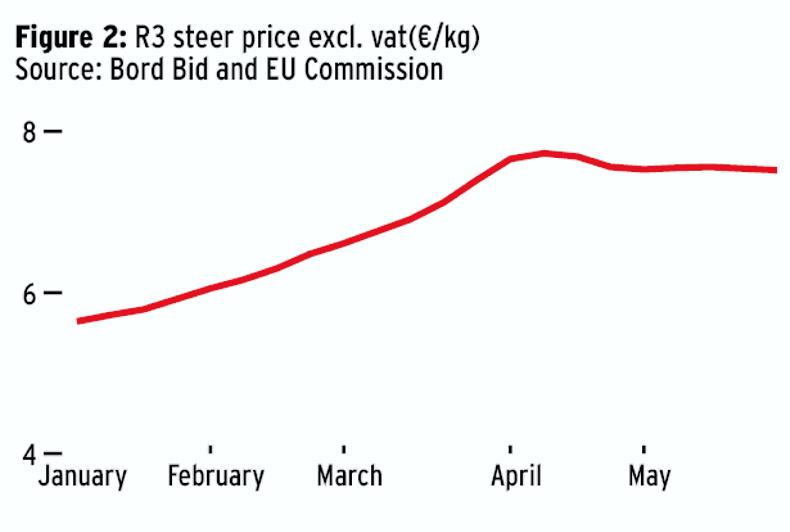

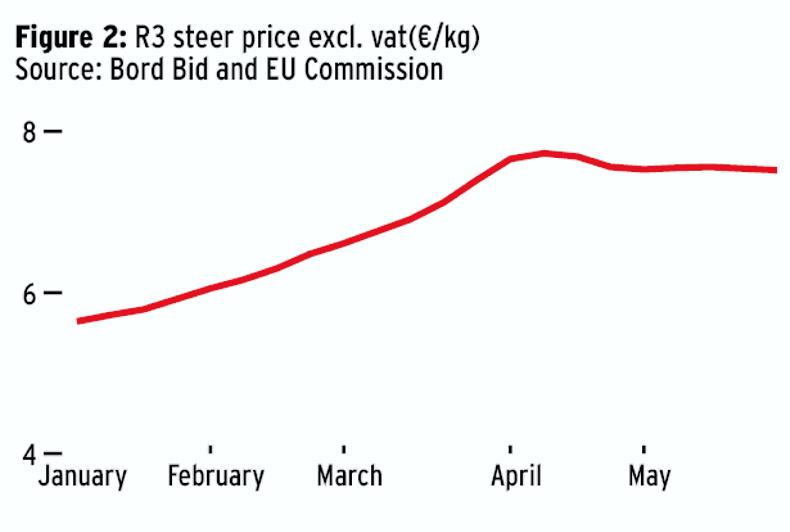

Figure 2.

The highest value cuts in the beef carcase are fillet, striploin and rump. These are all fast cooking and the most tender cuts of beef. Roasting cuts which are predominantly the topside, silverside and knuckle are slower cooking. Almost half the typical carcase will be used in mince/burgers or used in slower cooking stews. Some of this type of beef will also find its way into pie manufacture as an ingredient.

Figure 3.

With mince, the value is determined by how much fat it contains. Fat is a low value product and that means that the premium mince range will be 5% fat or less and the retail value of this product can get quite close to roast beef value. Even though there is a multitude of beef cuts in a carcase, as Figure 4 shows they can broadly be divided into three categories with a fourth category for bones, fat and gristle which all have low value.

Figure 4.

Comment – Value is determined by matching beef cuts to markets

Looking at the breakdown of a beef carcase, we can see that there is relatively little of the most valuable cuts and a huge amount of the carcase goes into mince, burgers or some other slower use. It is also notable that a large part of the carcase is bone, fat and gristle all of which are worth very little compared with the cuts of beef. The ability to sell each component part of the carcase in its highest value market is what makes for successful processing.

Read more

New factory beef price tracker

Browne’s bulls hit E grade

The week the Irish Farmers Journal has introduced a graph that shows an aggregated selling price received by factories for sales of 500g packs of 5% fat mince, a composite hindquarter and a composite forequarter price.

While most people will quickly relate to what a 500g pack of mince looks like, a composite hindquarter and forequarter price will only make sense to people with some knowledge of the beef trade.

Basically the composite value for the hindquarter and forequarter is calculated by taking the value of each cut of beef plus the fat, gristle and bone and applying their percentage share of the carcase to work out its contribution to the overall value. Working the value of beef sales back to a hindquarter and forequarter value is done by applying this to every single item that is sold from the carcase. It can be compared with building a jigsaw where the individual cuts of beef, fat, bones and gristles are the jigsaw pieces and the beef carcase is the completed picture.

Where the value lies

Figure 1.

Figure 1 shows the different types of beef cut that are taken from a carcase. It shows the individual weight of each cut and what percentage it is of the overall carcase. Some of these such as the striploin, fillet, and silverside will be familiar to beef shoppers while many of the others will be recognised only by people with a more detailed knowledge of the beef trade. It should also be noted that different customers have different specifications and this will effect the weight and yield of specific cuts.

Figure 2.

The highest value cuts in the beef carcase are fillet, striploin and rump. These are all fast cooking and the most tender cuts of beef. Roasting cuts which are predominantly the topside, silverside and knuckle are slower cooking. Almost half the typical carcase will be used in mince/burgers or used in slower cooking stews. Some of this type of beef will also find its way into pie manufacture as an ingredient.

Figure 3.

With mince, the value is determined by how much fat it contains. Fat is a low value product and that means that the premium mince range will be 5% fat or less and the retail value of this product can get quite close to roast beef value. Even though there is a multitude of beef cuts in a carcase, as Figure 4 shows they can broadly be divided into three categories with a fourth category for bones, fat and gristle which all have low value.

Figure 4.

Comment – Value is determined by matching beef cuts to markets

Looking at the breakdown of a beef carcase, we can see that there is relatively little of the most valuable cuts and a huge amount of the carcase goes into mince, burgers or some other slower use. It is also notable that a large part of the carcase is bone, fat and gristle all of which are worth very little compared with the cuts of beef. The ability to sell each component part of the carcase in its highest value market is what makes for successful processing.

Read more

New factory beef price tracker

Browne’s bulls hit E grade

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: