Self-employed farmers from lower income farms, such as beef and sheep, are less likely to be contributing to their pensions, new research has found.

The study - completed in collaboration between Maynooth University, Technological University Dublin and Teagasc - found that not all farmers have enough confidence in the pensions system to make that commitment.

The latest Central Statistics Office figures showed that one third of farm holders are 65 or older, while the State retirement age in Ireland is 66 years.

The Irish Government has stated its objective to increase overall supplementary pension coverage in Ireland to over 70%.

In 2023, approximately 54% of self-employed people (including farmers) in Ireland had supplementary pension cover.

Farmers under 66 years old with supplementary pension coverage by farming system.

The researchers said that farm incomes are too volatile, especially in sheep and beef, for farmers to make the investment.

“Income levels for these farm systems have been consistently low in recent years, making affordability a key issue in the consideration of supplementary pension coverage.”

Lack of confidence

For self-employed workers, supplementary pensions are entirely voluntary and take the form of personal pensions. Traditionally, supplementary pension coverage in Ireland has been lower for the self-employed than for employees.

For the study, researchers examined the percentage of farmers under 66 years of age who are contributing to a private pension.

This revealed that, overall, the rate of private pension coverage across the self-employed farming community was slightly over 50%.

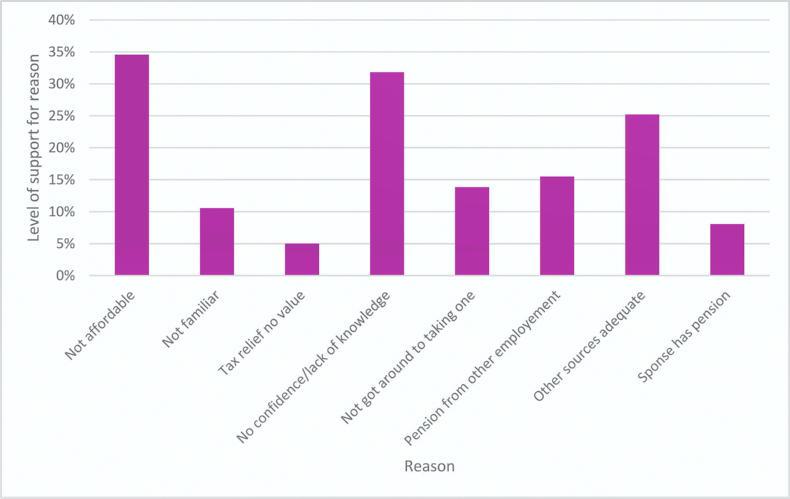

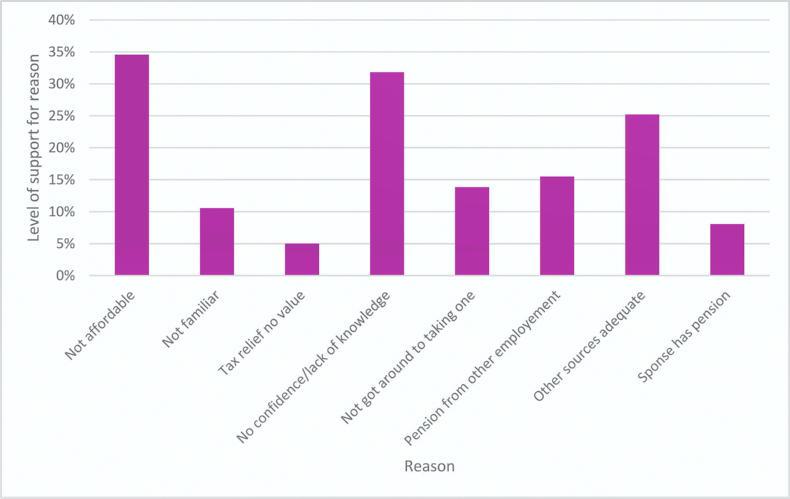

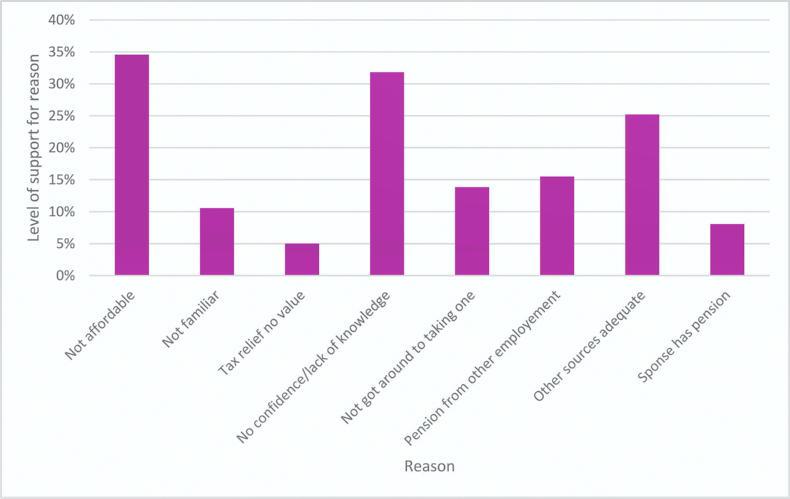

Farmers under 66 years old – reasons for not contributing to a private pension.

“It is interesting that lack of confidence in the pension system and apathy around setting up a pension featured consistently across all farm systems as reasons for not having a pension.”

Auto enrollment

Auto enrollment for pensions is due to be implemented in Ireland in 2026. However, this will not extend to the self-employed, including self-employed farmers, nor is there currently any equivalent proposals made for them.

In addition, the researchers have suggested a two-pillar system would be “necessary” in Ireland given the diversity of incomes across farm systems.

“The multi-pillar pension structure architecture is particularly appropriate and necessary given the diversity of incomes across farm systems.”

Self-employed farmers from lower income farms, such as beef and sheep, are less likely to be contributing to their pensions, new research has found.

The study - completed in collaboration between Maynooth University, Technological University Dublin and Teagasc - found that not all farmers have enough confidence in the pensions system to make that commitment.

The latest Central Statistics Office figures showed that one third of farm holders are 65 or older, while the State retirement age in Ireland is 66 years.

The Irish Government has stated its objective to increase overall supplementary pension coverage in Ireland to over 70%.

In 2023, approximately 54% of self-employed people (including farmers) in Ireland had supplementary pension cover.

Farmers under 66 years old with supplementary pension coverage by farming system.

The researchers said that farm incomes are too volatile, especially in sheep and beef, for farmers to make the investment.

“Income levels for these farm systems have been consistently low in recent years, making affordability a key issue in the consideration of supplementary pension coverage.”

Lack of confidence

For self-employed workers, supplementary pensions are entirely voluntary and take the form of personal pensions. Traditionally, supplementary pension coverage in Ireland has been lower for the self-employed than for employees.

For the study, researchers examined the percentage of farmers under 66 years of age who are contributing to a private pension.

This revealed that, overall, the rate of private pension coverage across the self-employed farming community was slightly over 50%.

Farmers under 66 years old – reasons for not contributing to a private pension.

“It is interesting that lack of confidence in the pension system and apathy around setting up a pension featured consistently across all farm systems as reasons for not having a pension.”

Auto enrollment

Auto enrollment for pensions is due to be implemented in Ireland in 2026. However, this will not extend to the self-employed, including self-employed farmers, nor is there currently any equivalent proposals made for them.

In addition, the researchers have suggested a two-pillar system would be “necessary” in Ireland given the diversity of incomes across farm systems.

“The multi-pillar pension structure architecture is particularly appropriate and necessary given the diversity of incomes across farm systems.”

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: