Southeast Asia is a dynamic, fast-growing region for the Irish food and drink industry with potential for further growth.

Bord Bia has identified six priority markets in the region: Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam.

These countries have a combined population of over 600 million and a combined GDP of €3.0tn. All experienced robust growth in 2023.

Bord Bia, along with the Department of Agriculture, embarks on a four-day trade mission to Vietnam and Thailand this month, following a trade mission to Malaysia and the Philippines last year.

Trade missions are a valuable means of raising the profile of Ireland and unlocking commercial opportunities for Irish exporters.

Bord Bia’s ambition for the trade mission, which will be led by Minister Pippa Hackett, is to build further on the strong partnerships Ireland has with customers in Thailand and Vietnam.

Ciaran Gallagher, Bord Bia regional director, South East Asia.

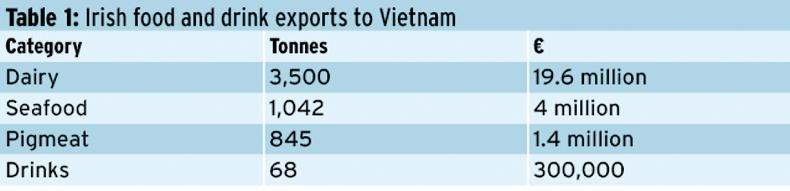

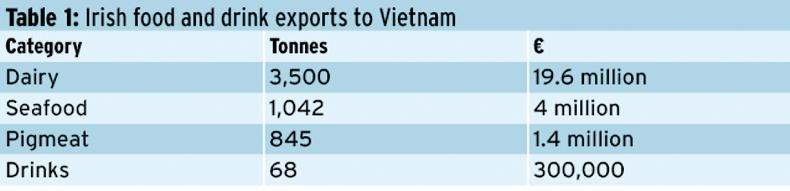

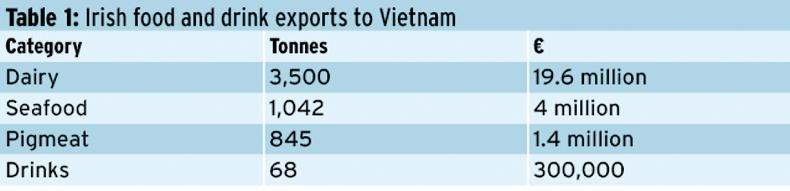

Irish food and drinks exports to Vietnam totalled €25.5m in 2023. The leading Irish export sector to Vietnam is dairy, followed by seafood (1,042 tonnes valued at €4m), and pigmeat (845 tonnes worth €1.4m).

A small quantity of drinks were also exported to Vietnam last year.

Irish dairy in Vietnam

Dairy products are among the top 10 growing food categories in Vietnam. Despite domestic production increases, dairy imports are forecast to grow further in the medium term.

As of 2022, dairy imports meet 60% of Vietnamese demand. In the medium term, this may increase slightly to 65%. Imported dairy is used as ingredients by the local industry.

Ireland exported 3,500 tonnes of dairy to Vietnam in 2023 valued at €19.6m. The main dairy export category is infant food (1,160t), followed by cheese (1,241t) and milk and cream (940t).

Ireland is a top-five supplier of cheese to Vietnam after New Zealand, Australia, France and Germany, according to GIRA, with exports increasing steadily since 2019.

Since 2023, Irish milk, cheese and whole milk powder exports to Vietnam are tariff-free under the EU-Vietnam free trade agreement.

From 2025, tariffs on all other EU dairy products will be phased out. This will improve Ireland’s competitiveness against Australia and New Zealand, which already enjoy tariff-free access.

To support Irish dairy exporters, Bord Bia has just completed a study into the fast-developing specialised nutrition sector in Vietnam. Specialised dairy products are growing in popularity in Vietnam and cater for a range of life stages and requirements such as sports nutrition and healthy aging.

The research aims to give insights to Bord Bia clients on how best to tailor their products to fit the market. This comes on the back of other research covering opportunities in Vietnam, including the Future of Dairy SE Asia (2022) and Dairy Ingredients for Foodservice Channel (2021).

Irish pigmeat in Vietnam

Ireland exported 845t of pigmeat to Vietnam in 2023. This was a fall of 52% after an unusually strong 2022. However, pigmeat exports have grown from 445t in 2019.

Bord Bia delivers an EU co-financed marketing campaign in South Korea, Vietnam and the Philippines using trade shows as a key vehicle to promote Irish food.

Irish food and drink exports to Thailand were valued at €57.5m in 2023. Exports are dominated by dairy with 16,988t, valued at just under €55m, exported last year.

Growth in disposable income over the past decade in Thailand has favoured dairy consumption.

There is a strong culture of innovation in the Thai dairy industry, making them world leaders in creating functional and nutritional dairy products.

This presents opportunities for Irish dairy exporters to supply high-quality ingredients for local manufacture.

This will be Ireland’s first agri-food trade mission to Thailand and an excellent opportunity to build closer partnerships with major players in the Thai dairy sector.

Other opportunities for Ireland are emerging from the modern and expanding retail, vibrant food service scene and growing middle class.

Irish dairy exports

Fat filled milk powder (FFMP) is the largest sub-category within Irish dairy exports to Thailand with 10,217t of Irish FFMP exported last year.

In 2023, Irish skim milk powder (SMP) exports totalled 2,430t followed by infant food at 1,858t.

Year to date (January to July) Irish dairy exports have already reached 14,539t, up 66% on the same period last year.

A rise in infant food exports is helping to drive this growth, with exports nearly trebling in volume. FFMP exports are up 37% to 7,833t.

Beef access

Ireland is in the advanced stages of securing beef access to Thailand. However, even once obtained, a secondary challenge remains in the form of tariffs.

Until a free trade agreement (FTA) is signed between the EU and Thailand, Irish beef will be subject to tariffs from 50% making it largely uncompetitive versus beef from origins such as Australia.

This FTA is currently under negotiation and once both hurdles are overcome, Irish beef can target the growing Thai food service channel, including high-end international hotels and restaurants.

In Thailand, Bord Bia will host a beef roundtable lunch in an effort to drive future opportunities between Irish exporters and leaders of the Thai food industry.

The event will focus on future opportunities, in particular beef, given ongoing discussions on market access.

EU campaign

Bord Bia is in the final year of a three-year dairy campaign promoting Irish and European dairy across five Asian markets including Vietnam and Thailand.

The primary objective of Bord Bia’s EU co-funded ‘European Dairy - Ireland, working with nature’ campaign is to raise awareness of Irish dairy’s availability and capability.

As part of the campaign, Bord Bia has held dairy seminars in Thailand and Vietnam to inform and introduce local buyers to Irish dairy.

Trade missions and the added ministerial and Government presence helps to attract a larger cohort of buyers to these seminars. A dairy seminar will be held in Bangkok, Thailand, during the trade mission.

Understanding the market in South East Asia

Lisa Phelan, Bord Bia manager South East Asia.

Lisa Phelan manages a team of eight and they look after six southeast Asian countries - Singapore, Malaysia, Philippines, Thailand, Vietnam and Indonesia.

The Irish Farmers Journal spoke to Lisa ahead of the trade mission to Vietnam and Thailand to see what further potential there is in these and other regional markets for Irish agrifood exports.

Lisa is originally from Dublin, but has spent the past decade living and working in the region, originally in industry and for the past year with Bord Bia.

When asked to highlight the big difference that makes the region different from Ireland, she explains that living on the equator means that it is “hot and humid all the year round”.

There is also a large mix of cultures and languages, though from the point of view of doing business, English is the language of choice unless for extremely technical issues when an exporter would need the services of a translator.

As for doing business, Lisa’s experience is that importers are familiar with the western norms of doing business and while there are regulatory and cultural variances, there is nothing to hinder trade whenever approval is in place.

“Historically the region didn’t have a great understanding or knowledge of Ireland, but that has been changing over the past decade through the work of Irish embassies, Enterprise Ireland and of course Bord Bia,” Lisa added.

She also pointed out that travel links between Ireland and southeast Asia have improved greatly and this greater connection also encourages trade.

What sells in southeast Asia

As for what Irish agri-food products the market wants, dairy and meat are dominant. Lisa explained that “Irish dairy is prominent in all markets in the region while access remains an issue in some countries for beef, though Philippines was the largest market outside Europe in 2023 for Irish beef exports, taking almost 8,500 tonnes last year”.

This was well down on previous years, but there is good recovery this year, with 6,700t exported to Philippines up to the end of July 2024. They have also taken almost 5,000t of Irish pigmeat up to the end of July.

Barriers

As for competition, Lisa identifies New Zealand as the number one competitor in dairy, with the US and Australia strong on beef, and Brazil and Russia big suppliers of competitively priced pork in the region.

Sheepmeat demand is serviced by Australia and New Zealand. Lisa admires the New Zealand marketing success of making themselves a close neighbour of the region despite, as she says, “it takes as long to fly from Singapore as it does to London”.

Notwithstanding the competition, she says that Ireland is a significant player particularly with dairy and milk powders.

Lisa Phelan also accepts that it isn’t a perfect market and getting beef access to Thailand and Vietnam “remain a priority for Ireland, though progress can be frustrating at times”.

She is more confident of an earlier breakthrough in Thailand where approval exists in principle, while Vietnam remains what she describes as “a work in progress”.

She also added that a trade mission that is led by a Government minister will also be “an opportunity to give the access negotiation a push”. Pigmeat has access to all of the markets in the region apart from Thailand.

Opportunities

While Singapore is a well-developed international city state, other countries in the region are much less developed.

Lisa Phelan explains that Vietnam, for example, remains relatively underdeveloped, but is changing and is one of the fastest-growing economies in the world.

“I visited it in June this year for the first time since before COVID and I was amazed by the changes.

“They are getting a lot of foreign investment and are attracting many companies relocating from China and the state is offering foreign companies land to build manufacturing facilities.

“It is actually one of the markets we probably see the most opportunity for Irish exports in the years ahead.”

Comment

Irish dairy and pigmeat exports have had considerable success in Asian markets for several years, while market access has frustrated opportunities to export beef and sheepmeat.

It is a competitive space, with strong competition from Australia, New Zealand and the United States in particular and South American countries are well established in China with beef.

Irish success has so far been confined to dairy and pigmeat, while beef has a foothold in some markets and remains knocking on the door of others.

Bord Bia work is particularly valuable in fledgling markets that are not yet fully developed, as where business is well established the exporting companies have already spotted and are developing opportunities.

Where there is little business, it is very much in the interests of Irish farmers that Bord Bia is the eyes and ears for opportunities that can be passed on to commercial interests for development and, in the process, expand the market opportunities for the produce leaving Irish farms.

Southeast Asia is a dynamic, fast-growing region for the Irish food and drink industry with potential for further growth.

Bord Bia has identified six priority markets in the region: Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam.

These countries have a combined population of over 600 million and a combined GDP of €3.0tn. All experienced robust growth in 2023.

Bord Bia, along with the Department of Agriculture, embarks on a four-day trade mission to Vietnam and Thailand this month, following a trade mission to Malaysia and the Philippines last year.

Trade missions are a valuable means of raising the profile of Ireland and unlocking commercial opportunities for Irish exporters.

Bord Bia’s ambition for the trade mission, which will be led by Minister Pippa Hackett, is to build further on the strong partnerships Ireland has with customers in Thailand and Vietnam.

Ciaran Gallagher, Bord Bia regional director, South East Asia.

Irish food and drinks exports to Vietnam totalled €25.5m in 2023. The leading Irish export sector to Vietnam is dairy, followed by seafood (1,042 tonnes valued at €4m), and pigmeat (845 tonnes worth €1.4m).

A small quantity of drinks were also exported to Vietnam last year.

Irish dairy in Vietnam

Dairy products are among the top 10 growing food categories in Vietnam. Despite domestic production increases, dairy imports are forecast to grow further in the medium term.

As of 2022, dairy imports meet 60% of Vietnamese demand. In the medium term, this may increase slightly to 65%. Imported dairy is used as ingredients by the local industry.

Ireland exported 3,500 tonnes of dairy to Vietnam in 2023 valued at €19.6m. The main dairy export category is infant food (1,160t), followed by cheese (1,241t) and milk and cream (940t).

Ireland is a top-five supplier of cheese to Vietnam after New Zealand, Australia, France and Germany, according to GIRA, with exports increasing steadily since 2019.

Since 2023, Irish milk, cheese and whole milk powder exports to Vietnam are tariff-free under the EU-Vietnam free trade agreement.

From 2025, tariffs on all other EU dairy products will be phased out. This will improve Ireland’s competitiveness against Australia and New Zealand, which already enjoy tariff-free access.

To support Irish dairy exporters, Bord Bia has just completed a study into the fast-developing specialised nutrition sector in Vietnam. Specialised dairy products are growing in popularity in Vietnam and cater for a range of life stages and requirements such as sports nutrition and healthy aging.

The research aims to give insights to Bord Bia clients on how best to tailor their products to fit the market. This comes on the back of other research covering opportunities in Vietnam, including the Future of Dairy SE Asia (2022) and Dairy Ingredients for Foodservice Channel (2021).

Irish pigmeat in Vietnam

Ireland exported 845t of pigmeat to Vietnam in 2023. This was a fall of 52% after an unusually strong 2022. However, pigmeat exports have grown from 445t in 2019.

Bord Bia delivers an EU co-financed marketing campaign in South Korea, Vietnam and the Philippines using trade shows as a key vehicle to promote Irish food.

Irish food and drink exports to Thailand were valued at €57.5m in 2023. Exports are dominated by dairy with 16,988t, valued at just under €55m, exported last year.

Growth in disposable income over the past decade in Thailand has favoured dairy consumption.

There is a strong culture of innovation in the Thai dairy industry, making them world leaders in creating functional and nutritional dairy products.

This presents opportunities for Irish dairy exporters to supply high-quality ingredients for local manufacture.

This will be Ireland’s first agri-food trade mission to Thailand and an excellent opportunity to build closer partnerships with major players in the Thai dairy sector.

Other opportunities for Ireland are emerging from the modern and expanding retail, vibrant food service scene and growing middle class.

Irish dairy exports

Fat filled milk powder (FFMP) is the largest sub-category within Irish dairy exports to Thailand with 10,217t of Irish FFMP exported last year.

In 2023, Irish skim milk powder (SMP) exports totalled 2,430t followed by infant food at 1,858t.

Year to date (January to July) Irish dairy exports have already reached 14,539t, up 66% on the same period last year.

A rise in infant food exports is helping to drive this growth, with exports nearly trebling in volume. FFMP exports are up 37% to 7,833t.

Beef access

Ireland is in the advanced stages of securing beef access to Thailand. However, even once obtained, a secondary challenge remains in the form of tariffs.

Until a free trade agreement (FTA) is signed between the EU and Thailand, Irish beef will be subject to tariffs from 50% making it largely uncompetitive versus beef from origins such as Australia.

This FTA is currently under negotiation and once both hurdles are overcome, Irish beef can target the growing Thai food service channel, including high-end international hotels and restaurants.

In Thailand, Bord Bia will host a beef roundtable lunch in an effort to drive future opportunities between Irish exporters and leaders of the Thai food industry.

The event will focus on future opportunities, in particular beef, given ongoing discussions on market access.

EU campaign

Bord Bia is in the final year of a three-year dairy campaign promoting Irish and European dairy across five Asian markets including Vietnam and Thailand.

The primary objective of Bord Bia’s EU co-funded ‘European Dairy - Ireland, working with nature’ campaign is to raise awareness of Irish dairy’s availability and capability.

As part of the campaign, Bord Bia has held dairy seminars in Thailand and Vietnam to inform and introduce local buyers to Irish dairy.

Trade missions and the added ministerial and Government presence helps to attract a larger cohort of buyers to these seminars. A dairy seminar will be held in Bangkok, Thailand, during the trade mission.

Understanding the market in South East Asia

Lisa Phelan, Bord Bia manager South East Asia.

Lisa Phelan manages a team of eight and they look after six southeast Asian countries - Singapore, Malaysia, Philippines, Thailand, Vietnam and Indonesia.

The Irish Farmers Journal spoke to Lisa ahead of the trade mission to Vietnam and Thailand to see what further potential there is in these and other regional markets for Irish agrifood exports.

Lisa is originally from Dublin, but has spent the past decade living and working in the region, originally in industry and for the past year with Bord Bia.

When asked to highlight the big difference that makes the region different from Ireland, she explains that living on the equator means that it is “hot and humid all the year round”.

There is also a large mix of cultures and languages, though from the point of view of doing business, English is the language of choice unless for extremely technical issues when an exporter would need the services of a translator.

As for doing business, Lisa’s experience is that importers are familiar with the western norms of doing business and while there are regulatory and cultural variances, there is nothing to hinder trade whenever approval is in place.

“Historically the region didn’t have a great understanding or knowledge of Ireland, but that has been changing over the past decade through the work of Irish embassies, Enterprise Ireland and of course Bord Bia,” Lisa added.

She also pointed out that travel links between Ireland and southeast Asia have improved greatly and this greater connection also encourages trade.

What sells in southeast Asia

As for what Irish agri-food products the market wants, dairy and meat are dominant. Lisa explained that “Irish dairy is prominent in all markets in the region while access remains an issue in some countries for beef, though Philippines was the largest market outside Europe in 2023 for Irish beef exports, taking almost 8,500 tonnes last year”.

This was well down on previous years, but there is good recovery this year, with 6,700t exported to Philippines up to the end of July 2024. They have also taken almost 5,000t of Irish pigmeat up to the end of July.

Barriers

As for competition, Lisa identifies New Zealand as the number one competitor in dairy, with the US and Australia strong on beef, and Brazil and Russia big suppliers of competitively priced pork in the region.

Sheepmeat demand is serviced by Australia and New Zealand. Lisa admires the New Zealand marketing success of making themselves a close neighbour of the region despite, as she says, “it takes as long to fly from Singapore as it does to London”.

Notwithstanding the competition, she says that Ireland is a significant player particularly with dairy and milk powders.

Lisa Phelan also accepts that it isn’t a perfect market and getting beef access to Thailand and Vietnam “remain a priority for Ireland, though progress can be frustrating at times”.

She is more confident of an earlier breakthrough in Thailand where approval exists in principle, while Vietnam remains what she describes as “a work in progress”.

She also added that a trade mission that is led by a Government minister will also be “an opportunity to give the access negotiation a push”. Pigmeat has access to all of the markets in the region apart from Thailand.

Opportunities

While Singapore is a well-developed international city state, other countries in the region are much less developed.

Lisa Phelan explains that Vietnam, for example, remains relatively underdeveloped, but is changing and is one of the fastest-growing economies in the world.

“I visited it in June this year for the first time since before COVID and I was amazed by the changes.

“They are getting a lot of foreign investment and are attracting many companies relocating from China and the state is offering foreign companies land to build manufacturing facilities.

“It is actually one of the markets we probably see the most opportunity for Irish exports in the years ahead.”

Comment

Irish dairy and pigmeat exports have had considerable success in Asian markets for several years, while market access has frustrated opportunities to export beef and sheepmeat.

It is a competitive space, with strong competition from Australia, New Zealand and the United States in particular and South American countries are well established in China with beef.

Irish success has so far been confined to dairy and pigmeat, while beef has a foothold in some markets and remains knocking on the door of others.

Bord Bia work is particularly valuable in fledgling markets that are not yet fully developed, as where business is well established the exporting companies have already spotted and are developing opportunities.

Where there is little business, it is very much in the interests of Irish farmers that Bord Bia is the eyes and ears for opportunities that can be passed on to commercial interests for development and, in the process, expand the market opportunities for the produce leaving Irish farms.

This is a subscriber-only article

This is a subscriber-only article