Our daughter moved to Dublin a few years ago to start her career. We’ve always hoped she might return closer to home eventually. She’s now planning to move back, and I want to give her a site on the edge of the farm to build a home. The plot is under an acre, and we’re hoping to do it before the Budget. I’ve heard it’s possible to transfer the site tax-free, but I’m worried about triggering Capital Gains Tax – or worse – messing up any future farm transfer. Is it safer to separate the site from the rest of the land?

ANSWER: Gifting a site to your child to help them build a home is generous and meaningful – but it must be handled with care, especially if the site is part of the farm. Without the proper steps, you could face unexpected taxes and jeopardise future farm reliefs. Let’s go through the key considerations.

Capital Gains Tax (CGT)

Parents can claim full CGT relief when transferring a site to a child for building their home, under section 603A of the Taxes Consolidation Act.

To qualify:

The site must be less than 1ac. The market value must be under €500,000.Your daughter retains the site for at least three years.If these conditions are not met (eg, if your daughter sells the site or rents it), a clawback of the relief applies – but it’s her liability, not yours. Still, proper follow-through is essential. Even when no tax is due, a CGT return must be filed to claim the relief, usually alongside your farm’s annual income tax return.

Capital Acquisitions Tax (CAT)

CAT is charged to the child, not the parent. There’s no automatic CAT exemption on a site gift, even between parent and child. The site’s value is treated as a gift and deducted from your daughter’s Group A threshold – currently €400,000.

For example, if this is her first gift and the site is valued at €100,000, there’s no CAT payable. But if she’s already received prior gifts, and this pushes her above the threshold, the excess is taxed at 33%.

Regardless of whether tax is due, a CAT return must be filed if 80% or more of the threshold has been used.

Stamp Duty: For stamp duty, the site is non-residential land, so the standard rate is 7.5%, even if it’s going to be used for a house. However, your daughter can apply for a stamp duty refund to bring the rate back down to 2%, or 11/15 if:

She starts building within 30 months, and/the house becomes her principal private residence.This refund is under the Residential Development Stamp Duty Refund Scheme, and is claimed through Revenue’s ROS system.Protecting Agricultural Relief: This is the most commonly overlooked issue. Agricultural Relief allows a 90% reduction in the taxable value of farmland during a transfer – but the site for a house isn’t considered agricultural land.

If you include the house site in the future farm transfer, it could:

Jeopardise Agricultural Relief if the land is no longer used for farming, or – Trigger a clawback if the site is later used for residential purposes and no longer qualifies.If your daughter isn’t farming the land or won’t meet the ‘active farmer’ test, Revenue may deny the relief.

The solution? Transfer the site separately under the section 603A CGT relief, and then do the main farm transfer later, with Agricultural Relief applied cleanly to the farmland.

Impact on other reliefs: If your daughter does plan to farm, she might qualify for:

Young Trained Farmer Relief – full exemption from stamp duty on farmland, if under 35, with a Green Cert, and commits to farming for five years.Consanguinity Relief – reduces stamp duty to 1% on transfers between family members.However, both of these reliefs are for agricultural land only, and won’t apply to a house site.

That’s why it’s crucial to:

Separate the site, so it’s not counted against the farmland.Avoid risking the full stamp duty relief on the rest of the farm being clawback.Maintain your daughter’s eligiblity for the Young Farmer exemption or Consanguinity Relief.

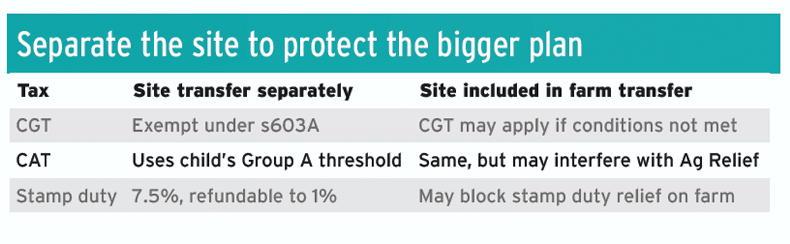

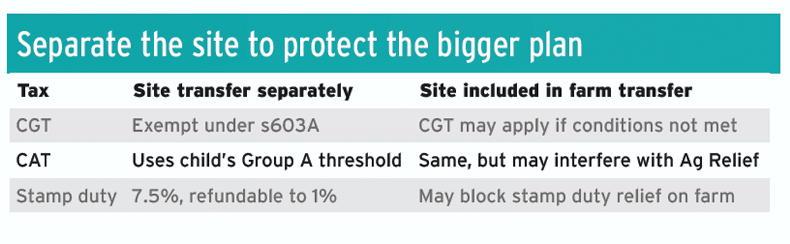

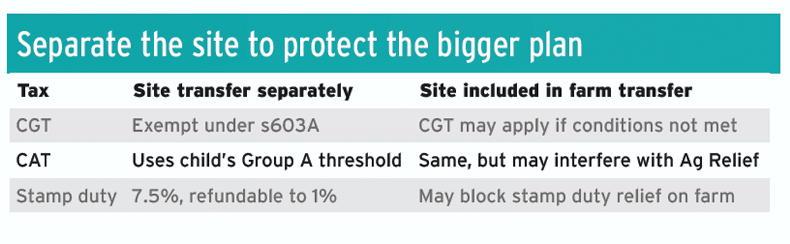

Table 1.

Marty Murphy is head of tax at ifac, the professional services firm for farming, food and agribusiness.

Our daughter moved to Dublin a few years ago to start her career. We’ve always hoped she might return closer to home eventually. She’s now planning to move back, and I want to give her a site on the edge of the farm to build a home. The plot is under an acre, and we’re hoping to do it before the Budget. I’ve heard it’s possible to transfer the site tax-free, but I’m worried about triggering Capital Gains Tax – or worse – messing up any future farm transfer. Is it safer to separate the site from the rest of the land?

ANSWER: Gifting a site to your child to help them build a home is generous and meaningful – but it must be handled with care, especially if the site is part of the farm. Without the proper steps, you could face unexpected taxes and jeopardise future farm reliefs. Let’s go through the key considerations.

Capital Gains Tax (CGT)

Parents can claim full CGT relief when transferring a site to a child for building their home, under section 603A of the Taxes Consolidation Act.

To qualify:

The site must be less than 1ac. The market value must be under €500,000.Your daughter retains the site for at least three years.If these conditions are not met (eg, if your daughter sells the site or rents it), a clawback of the relief applies – but it’s her liability, not yours. Still, proper follow-through is essential. Even when no tax is due, a CGT return must be filed to claim the relief, usually alongside your farm’s annual income tax return.

Capital Acquisitions Tax (CAT)

CAT is charged to the child, not the parent. There’s no automatic CAT exemption on a site gift, even between parent and child. The site’s value is treated as a gift and deducted from your daughter’s Group A threshold – currently €400,000.

For example, if this is her first gift and the site is valued at €100,000, there’s no CAT payable. But if she’s already received prior gifts, and this pushes her above the threshold, the excess is taxed at 33%.

Regardless of whether tax is due, a CAT return must be filed if 80% or more of the threshold has been used.

Stamp Duty: For stamp duty, the site is non-residential land, so the standard rate is 7.5%, even if it’s going to be used for a house. However, your daughter can apply for a stamp duty refund to bring the rate back down to 2%, or 11/15 if:

She starts building within 30 months, and/the house becomes her principal private residence.This refund is under the Residential Development Stamp Duty Refund Scheme, and is claimed through Revenue’s ROS system.Protecting Agricultural Relief: This is the most commonly overlooked issue. Agricultural Relief allows a 90% reduction in the taxable value of farmland during a transfer – but the site for a house isn’t considered agricultural land.

If you include the house site in the future farm transfer, it could:

Jeopardise Agricultural Relief if the land is no longer used for farming, or – Trigger a clawback if the site is later used for residential purposes and no longer qualifies.If your daughter isn’t farming the land or won’t meet the ‘active farmer’ test, Revenue may deny the relief.

The solution? Transfer the site separately under the section 603A CGT relief, and then do the main farm transfer later, with Agricultural Relief applied cleanly to the farmland.

Impact on other reliefs: If your daughter does plan to farm, she might qualify for:

Young Trained Farmer Relief – full exemption from stamp duty on farmland, if under 35, with a Green Cert, and commits to farming for five years.Consanguinity Relief – reduces stamp duty to 1% on transfers between family members.However, both of these reliefs are for agricultural land only, and won’t apply to a house site.

That’s why it’s crucial to:

Separate the site, so it’s not counted against the farmland.Avoid risking the full stamp duty relief on the rest of the farm being clawback.Maintain your daughter’s eligiblity for the Young Farmer exemption or Consanguinity Relief.

Table 1.

Marty Murphy is head of tax at ifac, the professional services firm for farming, food and agribusiness.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: